“Crypto, M.A.C.D., P.G. and S.T.B.: Understanding the spice chain of cryptocurrency technology”

While the cryptocurrency world develops at a rapid pace, investors, merchants and companies are looking for the potential of the curve. An area that has recently paid considerable attention is the slippery average convergence divergence (MACD) that provides a strong insight into market trends. In this article, we deal with the crypto world and examine the applications of MACD in the cryptocurrency trade, payment passageways and stable coins.

What is MACD?

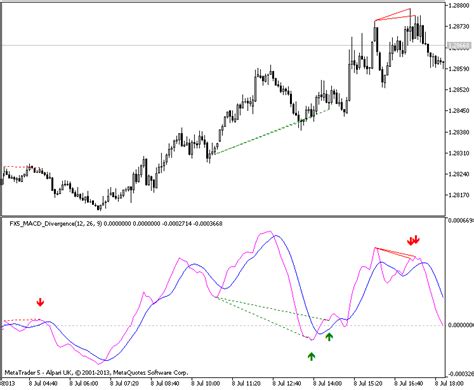

Moving average convergence divergence (MACD) is a technical analysis tool that uses two movable average values to identify trends and divergence. It works by calculating the difference between the two moving values of the price capacity over time. The first average is a simple moving average, 12 percent, while the second average is 26 perioda (exponential sliding average).

If the price exceeds the longer -term average, it shows a strong optimistic tendency while interpreting the bear below. If the two average values are different and indicate that prices are moving in the opposite direction, it can indicate the potential turning or continuation.

MACD in the cryptocurrency -trade

In the cryptocurrency trade, the MACD was largely based on the identification of tendencies and early warnings on market depression. By analyzing the Divergenci MACD line, retailers can get insight into their investment decisions. For example:

* MACD (12-26 periods) : The Bullish Crossover sign shows a strong upward trend.

* Long-term MACD (12-50 periods) : The bears crossing signs a strong downward trend.

MACD and payment passage

The use of MACD is becoming more and more popular with payment gateways, especially among merchants who want to minimize the risk of use. By analyzing the price movements of the assets, retailers can identify potential risks and opportunities within a certain time frame (for example, 12-26).

For example, a trader can use a 12 period MACD line:

MACD and stable coins

Stable coins are digital currencies placed on the traditional Fiat currency or other stable device. In order to maintain their stability, central banks and financial institutions have examined the paths of integrating MACD in the management of Stabrecoin.

For example:

* Price Stabilization : By analyzing the MACD line, a stable medalist can identify the potential volatility risks to take measures such as defense or rejection.

* Risk Management : Trading of stable coins with lower risk profile on the traditional stock exchange, while persons with higher risk profiles are stored in digital wallets or is offered through a special platform.

Diploma

Integration of MACD in the cryptocurrency trade has become increasingly popular with investors and merchants. By analyzing price movements within certain time frames, retailers can gain valuable insight into market trends and identify potential risks and opportunities.

In addition, the use of MACD in Pay Paying Gateway merchants offers an advanced tool to manage devices and minimize reductions. In the meantime, Stablecoin Management has opened new methods in innovation and risk management.

As the cryptocurrency landscape develops, it is important to continue to find out about the latest developments in technical analysis and financial tools. If you understand that MACD, payment gateways and stable coins are used in various areas, retailers can be increasingly made and maximizing their investment returns.

© 2022 – Potenza Building Material