“Bitfinex Crypto Trading Signal and Limit Order Market Review: A deep dive into cryptocurrency negotiating opportunities with a limit approach”

**

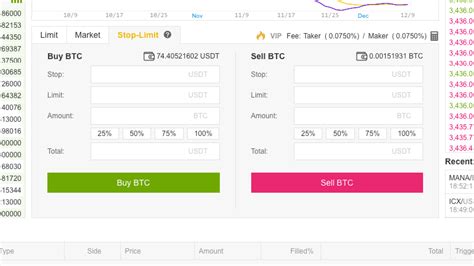

In today’s fast -paced cryptocurrency market, traders are constantly looking for new ways to maximize their profits and minimize their losses. Among the various strategies and trading tools available, one approach that has gained significant attention in recent years is to use limited orders when negotiating on platforms like Bitfinex.

What is a limit order?

A Limit Order is an automated purchase or sale signal sent to a trading platform at a specified price level. It allows traders to define specific parameters for their negotiations, such as the minimum and maximum prices at which they are willing to enter or leave a position. This type of order can be performed only when the conditions described in the order are met.

Bitfinex Crypto Trading Signal

Bitfinex is one of the largest and most popular cryptocurrency exchanges in the world, offering an extensive range of commercial pairs, liquidity pools and innovative features. The platform’s encryption trading signal system allows traders to set limited orders based on various market conditions and indicators.

Some of the main factors that contribute to the Bitfinex encryption negotiation signal system include:

2.

3.

Review of the Limited Order Market

Limited orders are a powerful tool for traders to run negotiations at specific price levels, allowing them to block profits or limit their losses. When used correctly, limitless orders can be highly effective in the encryption negotiation signal system.

See how limited orders work with Bitfinex:

Benefits of using limited orders in Bitfinex

Limit orders provide traders the flexibility of adjusting their positions based on changes in market conditions.

Conclusion

Limited requests are a valuable negotiation strategy that can be used effectively when combined with Bitfinex’s encryption trading signal system. By setting specific price levels and adjusting to market conditions, traders can maximize their profits and minimize their losses. If you are an experienced trader or just starting, exploring the world of limited orders on Bitfinex is definitely worth considering.

Responsibility exemption: This article is only for informative purposes and should not be considered as an investment counseling. Always do your own research and consult a financial consultant before making commercial decisions.

© 2022 – Potenza Building Material